Share

Author

George Anderson

Share

Parts Industries & eCommerce

B2B eCommerce is nothing if not disruptive. This is especially true in spare parts industries. From automotive to industrial and everything in between, parts manufacturers are grappling with the competitive threat of eCommerce.

That threat typically takes two forms: competitive pressure from marketplaces like Amazon Business, and pressure from competitors who’ve already launched their own branded eCommerce experiences for spare parts.

Here’s what this threat means for parts manufacturers—and what you can do about it.

The scope of the eCommerce threat in spare parts industries

Digitalcommerce360 report

B2B decision-makers across several verticals are scrambling to deal with the disruption which eCommerce causes. Digitalcommerce360 reports on a study of parts suppliers which asked them how eCommerce competition was impacting their business.

One question in particular stood out to us. When respondents were asked what threat level eCommerce represented at their company, their answers broke down like this (the options were “no threat,” “minor threat,” and “transformational threat”).

- Automotive – 64% reported that eCommerce was a significant or transformational threat

- Energy/utilities – 60% reported that eCommerce was a significant or transformational threat

- Industrial – 43% reported that eCommerce was a significant or transformational threat

McKinsey briefing

A recent market report from McKinsey on spare parts eCommerce corroborates these findings. McKinsey offers two telling stats:

- 25% of surveyed companies in the space have digitized their spare parts and consumables business.

- Over 2/3 of those surveyed plan to digitize their spare parts and consumables business.

McKinsey put it this way: “With advanced digital know-how, tech giants [i.e. Amazon, Alibaba, etc.] have boldly inserted themselves in [the] links of the manufacturing value chain and threaten to stand directly between manufacturers and their customers.”

In other words, the threat is nothing less than loss of control over the customer relationship.

Clearly, parts manufacturers need to act.

Option 1: Partnering with competitors to create a B2B marketplace

The McKinsey briefing recommends this path for parts suppliers as a way to deal with the threat of marketplace giants like Amazon.

It’s an interesting strategy—but it does have flaws.

Essentially, the idea is that competitors and “frenemies” in aftermarket parts and consumables could band together and launch a collaborative digital marketplace as a counterweight to Amazon Business, Alibaba, and so on. The McKinsey report offers some ideas on how to do this technologically (use the eCommerce infrastructure of one of the partner companies), politically (have strong agreements in place to balance power between the companies), and so on.

Obviously, this approach carries some inherent risks. McKinsey identifies them towards the end of their whitepaper—but the risks are actually quite significant.

- Unless each player agrees to restructure their business to eliminate overlap (a cooperative effort which requires democratic coordination between the companies), competition will remain. Eventually, it could destabilize the multi-partner relationships.

- As McKinsey puts it, a company considering this solution “will need to weigh the upside of convenience against the risk of losing their customer relationship to the platform provider.”

- As far as developing a marketplace platform in-house, McKinsey cautions against this, as it may lead companies to “overinvest in features that are already commodities.” They go on to note, “Scalability may also be an issue when using a completely in-house platform.” We totally agree.

For some companies, a frenemy marketplace may be a viable option. For companies who don’t want to take on those risks, there is another path—launching your own branded eCommerce channel to sell parts and consumables.

Option 2: Grow customer value through your own branded eCommerce experience

This approach is fairly straightforward. Rather than forging an alliance with other companies who partially or totally compete with you, you simply launch your own branded eCommerce channel.

This scenario mitigates all the risks of the frenemy marketplace:

- You control every transaction that happens in the channel.

- You retain full control over branding, merchandising, recommended products, and product substitutions.

- You retain proprietary data-driven insights on your customers’ buying patterns.

- You show customers that their desire for self-service buying is important to you.

Now here’s the trick: the frenemy marketplace does have one advantage—it pulls your customers away from Amazon, to a place where they can get more value than they receive from you alone.

In other words, the total value which you and your frenemies offer is greater than the total value which Amazon offers in any particular procurement initiative.

Actually, there is a way for parts manufacturers to offer this kind of value in their own branded eCommerce stores. The key is to borrow from the business model of distributors and start selling 3rd party products that increase your total value to the customer in completing whatever job brought them to your eCommerce store. Get a larger share of wallet for that job at hand, and do it again and again, and you’re on the way to building a deep relationship of trust with the customer.

Here are two articles to get you started on the possibilities:

The Takeaway

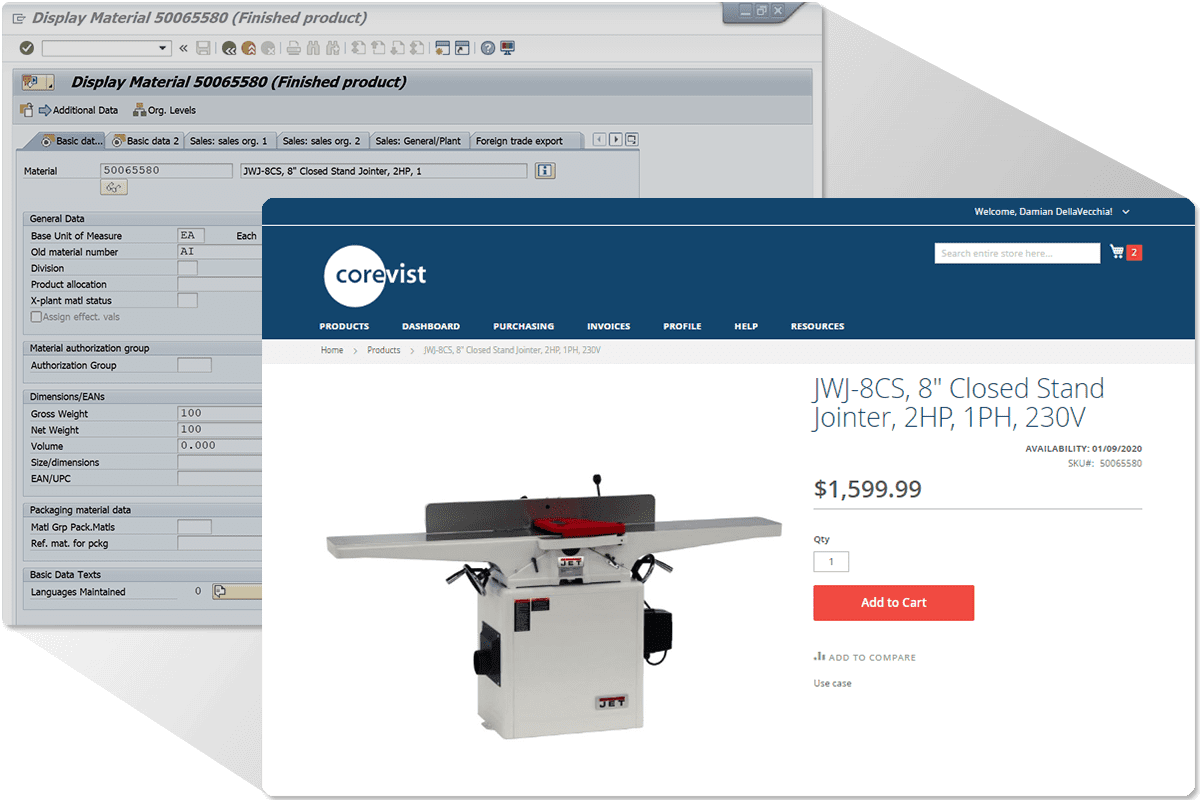

Corevist Commerce was built to deal with the problems which parts manufacturers face in the digital age. Our solution is a holistic, SAP-integrated eCommerce platform ideally suited to parts industries:

- Corevist supports exploded, interactive parts catalogs with one-click add-to-cart.

- Corevist’s intuitive browsing experience makes it easy to suggest related products in the eCommerce store (whether your own, or those from 3rd parties).

But Corevist Commerce doesn’t stop there. We go beyond standard B2B eCommerce functionality:

- Our built-in SAP integration ensures all data in Corevist Commerce is ERP-accurate.

- Our SAP integration also ensures that Corevist Commerce only posts 100% error-free orders to SAP ERP.

- Customers can view and interact with full SAP order history from all channels.

- Customers can view all invoices, select unpaid invoices, and pay them off through self-service electronic payments.

Looking for a B2B eCommerce solution?

Corevist Commerce is built for manufacturers. Real-time SAP integration, visual parts ordering, and more.

Moving forward: FREE case study

Want to see what spare-parts eCommerce looks like in real life? Download this case study on Bell and Howell. You’ll learn how this manufacturer took a struggling spare parts business and turned it around with Corevist Commerce. The best part? Bell and Howell did it with minimal effort on the part of their IT team.

[want_more title=”Learn more” subtitle=”FREE Case study: Ecommerce Success in Spare Parts” description=”Learn how Bell & Howell revived a struggling spare parts business with ecommerce and grew revenue $200k+ in the first 60 days after launch.” button_text=”Download Now” button_link=”https://www.corevist.com/bell-howell/” button_class=”btn btn-primary bh-spare-parts” title2=”See it for yourself” subtitle2=”Talk to us” description2=”Curious what Corevist Commerce can do for you? Let us show you a personalized demo. You’ll see ecommerce with real-time SAP data.” button_text2=”Schedule Demo” button_link2=”https://www.corevist.com/demo/” button_class2=”demo-popup”]