Share

Author

George Anderson

Share

Digital Transformation In Payments

The COVID-19 pandemic has driven dealers and distributors to seek out digital ways of doing business. For manufacturers, that means the timeline for digital transformation has accelerated. Where digital solutions were sitting on backlogs as “things we need to do, someday,” they are now becoming top priority for many manufacturers.

Yet how can manufacturers launch digital transformation in manageable iterations? Can organizations get “quick wins” and expand as they go?

Absolutely. In fact, self-service payments is a great entry point to transforming customer experience. With the right architecture, a self-service payment solution positions manufacturers to add SAP-integrated eCommerce in future phases—and it addresses a real need today.

The problem: A lack of transparency empowers dealers/distributors to leave invoices unpaid

A lot can go wrong when manufacturers depend on paper-based processes for A/R. Without a single, interactive portal where dealers and distributors can manage their accounts through self-service, the account rectification process becomes fuzzy and uncertain—especially in the post-COVID world.

In our experience, manufacturers with paper-based processes tend to get these kinds of questions from customers:

- “We can’t find our invoice. Can you send it again?”

- “Our latest statement contains errors. I spoke to someone on the phone about this two weeks ago, but this statement doesn’t reflect that conversation. Can we get an updated, accurate statement?”

- “We’re not sure how to apply this partial credit to our open invoices. Can you explain the process?”

Unfortunately, when customers have these kinds of questions (which require manual inquiries and back-and-forth communication), the end result is often unpaid invoices.

It’s not that customers want to leave invoices unpaid. Rather, paper-based workflows introduce uncertainty, and that uncertainty slows down the process. When customers don’t know what to do next, the easiest thing in their workday is to move on to a task that offers a clearer path to completion.

The solution: Self-service invoice payment portal, integrated to SAP in real time

At a high level, what information do dealers/distributors need to keep their accounts in good standing?

They just need transparency.

They need visibility into open items, invoices, and full invoice history. They need all this information in real time, and they need to know that it’s 100% accurate in real-time so they can trust it.

In addition, they need access to this information through self-service, on any device, 24x7x365. And they need the ability to select invoices and pay them down through your preferred payment methods—like credit/debit card, ACH transfer, eCheck, or Paypal.

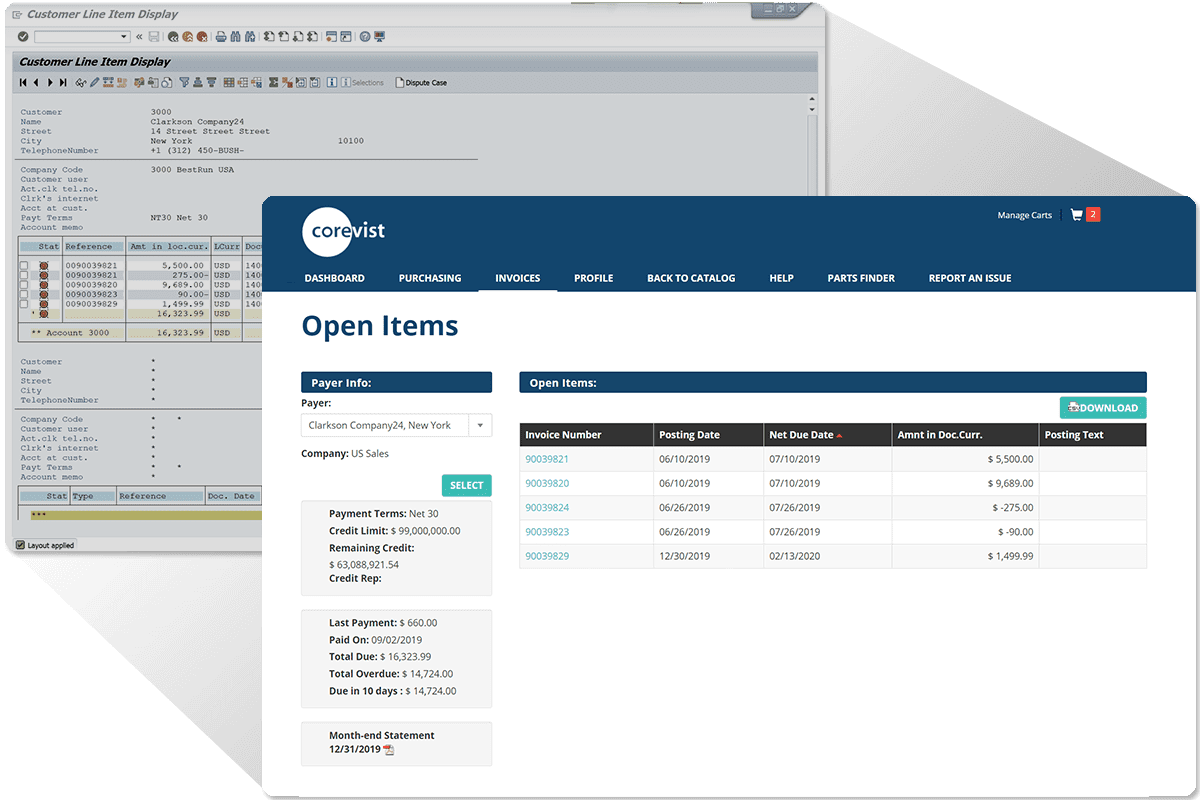

An SAP-integrated payments portal checks all of these boxes. It gives customers 100% transparency and 100% self-service control over their account standing. That’s the thinking behind Corevist Bill Pay, which offers a fully personalized experience for each customer, driven 100% by SAP business rules and historical data:

Since customer account data lives in SAP, it stands to reason that a self-service payments portal needs to interact with SAP in real time. Customers need up-to-the-minute status on account standing and invoices. When they process a payment, it should post to SAP instantly, with the portal displaying the new account balance and new invoice status immediately.

If a portal solution can’t provide these things, it isn’t truly self-service. Without real-time account standing, customers will have to call Customer Service to find out if their next order will go on credit block. Without self-service payments, customers won’t be able to take action to correct their account standing and keep placing orders.

Once you’ve solved the payments problem, another question arises: What other processes can you transition to self-service? What about product browsing, online ordering, and order tracking?

Read on…

Payments today, commerce tomorrow

Self-service payments is a great place to start your transformation of customer experience. Everyone wants to pay their bills (so their accounts don’t go on credit block). That means customers have a natural incentive to adopt your payments portal.

The key is to choose an expandable solution like Corevist (which allows you to add online ordering, product catalogs, and order tracking to your SAP-integrated commerce/payments architecture). This allows you to onboard your users to the payment portal in Phase I, then expand the solution to cover more business processes in Phase II (or Phase III, IV, etc.). With your customers already committed to the portal for payments, they’re primed to move to online ordering when you add that functionality to your portal.

A scalable architecture like this empowers you to transform customer experience in multiple iterations. You can gain a quick win from the first phase, then use that success to power your continuing transformation.

Moving forward: FREE case study

Want to see Agile digital transformation in real life? Download this case study on Blount International. This leading manufacturer of durable equipment needed to transform customer experience. They started with Corevist Order Tracking, then expanded to online ordering, added multiple brands/geographies, and grew digital revenue 325%.

[want_more title=”Learn more” subtitle=”FREE Case study: Blount International” description=”Learn how multiple departments came together as Blount International launched ecommerce.” button_text=”Download Now” button_link=”https://www.corevist.com/blount-international-inc/” button_class=”btn btn-primary blount-case-study” title2=”See it for yourself” subtitle2=”Talk to us” description2=”Curious what Corevist Commerce can do for you? Let us show you a personalized demo. You’ll see ecommerce with real-time SAP data.” button_text2=”Schedule Demo” button_link2=”https://www.corevist.com/demo/” button_class2=”demo-popup”]