WHITE PAPER | D2C Best Practices

Selling Direct: 8 Keys To Success For Manufacturers

Dealing with channel conflict, small quantity fulfillment, and more.

D2C strategy for manufacturers

Every manufacturer is grappling with the question of selling direct. Organizations must consider the overall impact of a direct model and develop a plan for actualizing the opportunities (and mitigating the risks).

Ultimately, there are no right or wrong answers. Each manufacturer must craft a journey that fits their market and balances benefits and drawbacks appropriately.

We’ll cover all that and more:

1. Map the politics of D2C at your organization

2. Define how your new distribution strategy will be your competitive edge

3. Define how close you want to get to the end user (but prepare for the unexpected)

4. Map the eCommerce responsibility you’ll take on as you get closer to the end user

5. Answer the “make to order” question

6. Answer the logistics question

7. Define your Amazon strategy

Why go direct?

Manufacturers typically have a simple reason for going direct: When you eliminate the distributor, you take greater control of the transaction with the ultimate customer, and that gives you more tools both to close today’s sale, and to generate future sales from the same customer.

The thinking goes like this: Distributors act as a buffer between you and the end users of your products. Not only do they buffer the transaction, but they also buffer your knowledge of how the customer uses your product.

This is why in some markets, for some manufacturers, distributors may actually do more harm than good. Alongside your products, they also represent competitive products—and they may even show preference for those products over yours.

When you look at a scenario like this from a growth perspective, your distributor is now “gating” your growth. They’re acting as a constraint on it.

Of course, going direct requires an all-new GTM (go-to-market) strategy. It’s not a simple flip of a switch. You need to ensure you’ve got all your bases covered—that you’re addressing the entire scope of the problem in defining a direct-to-consumer model.

That’s why we put together this list. Here’s what you need to cover:

1. Map the politics of going direct (and the impact to your overall business)

In many cases, there’s no way around it: Going direct will upset some (or all) of your channel partners.

Depending on your relationship with them, they may view the move as a competitive threat. At the very least, they’ll see it as a reduction in the value which you place on your relationship with them.

How do you orchestrate a move to selling direct which also preserves your valuable relationships with channel partners?

Luckily, selling direct doesn’t have to be “all or nothing.” There are many ways to sell directly to end users without severing ties with every channel partner. You can sell direct:

- By product. If you discontinue selling a particular product (or product line) via channel partners but keep other product lines available to them, you can start selling direct without ending your existing relationships.

- By geography. With a given product line, you can sell direct in one geography while retaining distributors/dealers in other geographies. Maybe you sell direct in the EU, but keep selling through distributors in the US.

Wherever you plan to sell direct, you’ll want to map the impact which the decision will have on your relationships with channel partners. In an intelligent direct strategy, the benefit will outweigh any potential cost. You’ll want to do the math and determine what mix of direct and traditional distribution is right for your organization.

2. Define how your new distribution strategy will be your competitive edge

Here’s a challenging statement: Next to your products, your distribution strategy is your competitive edge.

Traditionally, manufacturers haven’t attempted to differentiate themselves based on distribution strategy. The product was enough, and channel partners would take care of competitive distribution. Yet the digital world has disrupted this model and forced manufacturers to consider two facets of the “total value” they offer customers:

- Product as a competitive differentiator. Your products differentiate you clearly against anyone else. Functionality, features, unique selling proposition—these add up to create your unique niche in the market, the value which your customers can’t get anywhere else.

- Distribution strategy as a competitive differentiator. Access to your products offers additional competitive differentiation. Your distribution channel that gets this. Since you already provide the value of the product, the distribution channel’s strategic imperative is to provide access to the product that isn’t available anywhere else.

There’s no reason you, as the manufacturer, can’t provide both kinds of value to your end users.

The key to using your distribution strategy as a differentiator

The digital world is in constant flux. What worked this year or this quarter may not work again.

To succeed here, you have to support an experimental mindset and stay Agile. That means:

- Testing one iteration of your new distribution strategy

- Measuring your results

- Tweaking the model accordingly

- Testing again

When you institute a culture of experimentation and Agility, you position your organization to stay competitive in the digital age.

3. Define how close you want to get to the end user (but prepare for the unexpected)

When you’re considering the prospect of going direct, it’s easy to imagine yourself in full control of the situation. But the control you have today could evaporate tomorrow.

This happened to one of our clients. Due to circumstances beyond their control, they lost their distribution channel on the US West Coast. The demand for their products was still strong, but the middleman wasn’t there. The company had to redefine how close they would get to the end user of their products. And ultimately, they had to go direct, whether they wanted to or not.

A few years in, our client is thriving with their direct model. Now that they’ve done it, they realize it’s not that bad. They’ve tackled the logistics, set up a warehouse, staffed it—and they’re not looking back.

Diversify your model

We have another client who sells through all kinds of distribution models. In some territories, they’re incredibly close to the consumer—while in others, they’re using a traditional dealer/distributor relationship. Here’s what that looks like across the organization:

- Brick-and-mortar retailers. Their B2C-oriented products are sold through big box stores.

- D2C online. The company’s consumer products are available directly online, too, through a B2C eCommerce presence.

- Dealers. The company maintains a network of dealers for their heavy-duty equipment, as this model allows buyers to get the best value from the right product.

- Distributors. The company’s business customers still prefer to buy through distributors, so the company maintains those relationships for the appropriate product lines.

The bottom line: Define how close you want to get to the customer

At some point, every manufacturer has to understand that the ultimate customer is not their channel partner. The ultimate customer is the end user.

The larger the buffer you put between yourself and the ultimate customer, the slower your response time will be as trends in the market evolve. Ultimately, that distance and slowness insulates you from the needs of the ultimate customer. Taken to the extreme, that’s a dangerous place to be.

Of course, there’s a tradeoff. The less buffer you have between your organization and the end user, the more Agile you have to be. Closeness to the end user will demand flexibility and fast pivoting.

Some of it is beyond your control, too. Every manufacturer wants to get closer to the consumer, but your business may only allow so much closeness. The supply chain and the nature of the product will place inherent limits on how close you can get.

The key is to map all this, highlight opportunities to get closer, and act on them.

4. Map the eCommerce responsibility you’ll take on as you get closer to the end user

With great power comes great responsibility. Getting closer to the consumer gives you greater power over the transaction—and you take on more responsibility in the process.

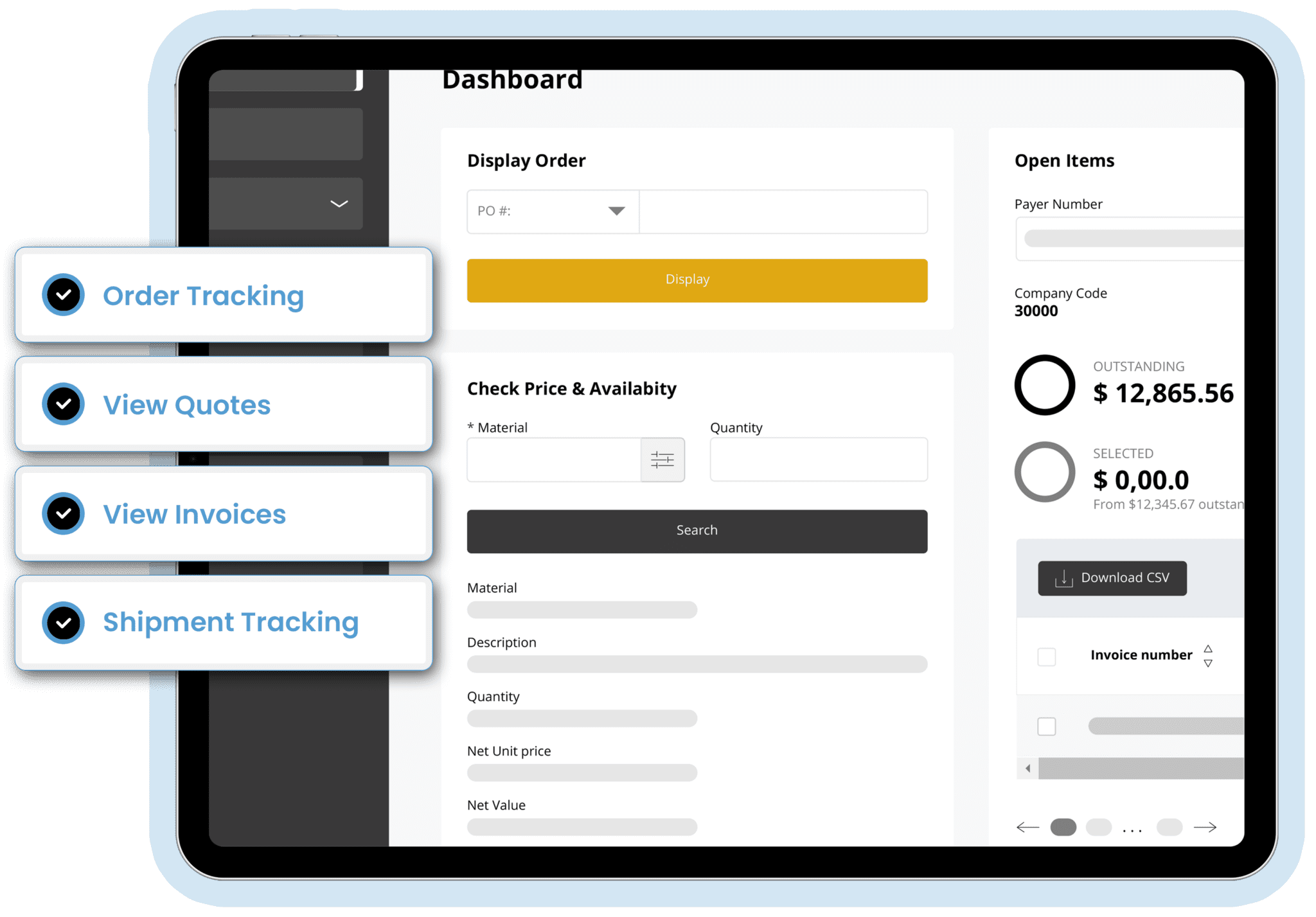

Specifically, you’ll need to map the end user’s needs for a B2C-style eCommerce experience. This is new ground for some manufacturers—but it’s not as hard as you might think.

Depending on your market, a B2C-style web store could include several different things:

- Configurable products. If you’re selling products with multiple configurable attributes, you’ll need to provide a way for customers to configure the product in the web store. Typically, this requires a CPQ (configure/price/quote) solution integrated to SAP VC.

- Product catalog + rich content. Many manufacturers have a digital portal solution for their channel partners—but end users may need more than just order entry and account management. A product catalog with rich content empowers your end users to understand your products better and make intelligent decisions.

- Credit card payments. This, too, is new ground for some manufacturers. When you’re selling to channel partners, you may not need to take any kind of electronic payment. But end users are a different story. If they’re consumers, rather than businesses, you’ll have to take credit cards—but business customers may prefer this method, too.

If your customers need any of this functionality (and most manufacturers find that their end users do), you’ll need to provide it in your eCommerce solution or digital customer portal.

5. Answer the “make to order” question

This is arguably the biggest challenge which manufacturers face in selling direct. Manufacturers are tooled up to “make to stock”—to produce large quantities meeting forecasted demand across an entire market segment.

But the end user may not buy tens, hundreds, or thousands of units. Depending on the market and product, they may want to buy in quantities of 1.

To meet this kind of demand, manufacturers must retool their operations to support a “make to order” model. In this situation, the manufacturing process begins after an order is placed, and the process must be able to produce a quantity of 1.

If you intend to keep selling to dealers/distributors in other territories or product lines, you may need to support a “make to order” supply chain alongside “make to stock.”

The challenge, here, is forecasting demand. While there are no clear-cut answers, it’s worth noting that eCommerce analytics offer insight into seasonal variability and buying trends. Learn more here: 4 Key Metrics for Growth-Oriented eCommerce.

6. Answer the logistics question

When manufacturers are looking at selling direct, it’s easy to focus on the negative aspects of traditional distribution.

While that’s understandable, manufacturers should take a balanced view.

In many cases, distributors actually provide a lot of value. This is especially true in geographical storage and fulfillment. If you have a manufacturing plant on the US East Coast, and lots of customers on the West Coast, you’ll run into new fulfillment challenges if you don’t have a warehousing presence on the West Coast. When a West Coast customer buys something, it will cost the manufacturer more time and money to get the product there.

If you have a local distributor who’s stocking product for you, they can deliver it almost immediately—as long as it’s not a “make to order” scenario.

As you’re preparing your direct model, make sure you cover logistics from a geographical perspective.

7. Define your Amazon strategy

Manufacturers are scrambling to understand the opportunities (and threats) which Amazon poses to their various lines of business. While the answer looks different in every vertical (often, even in different product lines), one thing is clear: manufacturers can’t ignore Amazon.

Amazon Business is expected to hit $52 billion in revenue by 2023.

While it’s easy to say “we should be there,” manufacturers should do their homework. There are many questions which organizations need to answer before jumping in.

For a deeper dive on Amazon strategy for manufacturers, check out the webinar we hosted with Brian Beck, renowned Amazon B2B expert.

8. Answer the eCommerce platform question

If there’s one common thread here, it’s this: you really need an eCommerce platform that’s flexible enough to handle the needs of both dealers/distributors, and end users. The problem isn’t trivial. A conventional B2C platform can’t handle the needs of your channel partners, which puts you in B2B eCommerce territory—but B2B eCommerce may not be right for your direct channel if the end user is a B2C consumer.

The differences in the needs of these personas are fairly significant:

- Freight selection. What SAP ERP business rules govern freight selection for your channel partners? How about your direct customers? Those scenarios are totally different. Now the platform has to fit two sets of business rules around shipping/freight. (Hint: Corevist products achieve this through direct, real-time SAP integration which supports the business rules associated with the customer in SAP.)

- Taxes. The eCommerce platform has to support multiple tax scenarios. Depending on the customer type, which products are taxable, and which aren’t? Can you have multiple types in one cart? At what level will you calculate taxes? What happens if you’re going to do a dropship? How do you calculate taxes on that? The platform should support all answers to these questions which your business requires. (Hint: If those rules are defined in SAP, you’re in luck—Corevist brings the appropriate tax rules to the web store in real time.)

- Payments. What kinds of payments will you accept? When will you accept them—at checkout, or in an invoice payoff scenario? Your direct customers may have different needs than channel partners when it comes to eCommerce payments.

- Personalized catalogs. More and more manufacturers are asking for this feature. They need their web store to present different catalogs to different customers—and that need is especially apparent when you’re differentiating between direct customers and channel partners. So how do you achieve personalized catalogs at minimal cost? Corevist does it through our prebuilt SAP integration, which comes standard with all Corevist products. Read more here: Corevist’s 53 SAP integration points.

- RDD (requested delivery date). If you’re going to support channel partners and direct consumers on the same platform, you’ll need to define how you want to handle RDD. Your channel partners need the ability to request a delivery date—but for direct consumers, you probably want to just tell them when it will ship. How do you handle that in the web store? (Note that Corevist supports your existing RDD business rules for the channel partner side of the business.)

- SEO. The channel-partner-side of your web store may or may not have a public catalog. But your D2C channel requires one. Now you’re in the realm of SEO. How will you optimize your catalog for Google and other search engines? The question isn’t trivial, as organic search is a huge source of traffic for manufacturers engaging in a direct selling.

The bottom line

You need a flexible platform for an omnichannel scenario. It should offer:

- Minimal effort to deploy and maintain, with SAP integration included. (Note: This is the thinking behind Corevist Commerce.)

- Accommodation of complex SAP ERP business rules, plus the flexibility to handle the D2C channel, too.

- Right-sized fit for your organization. In many cases, the effort required to stand up the eCommerce solution and integrate it to SAP is cost-prohibitive for organizations under $5 billion in total annual revenue. Check out our in-depth B2B eCommerce Platform Comparison chart for more information.

B2B eCommerce Case Study:

- Agricultural and forestry equipment manufacturer

- 1001-5000 employees

- Needed B2B solution integrated to ERP

- IT staff already at capacity