Share

Author

Tomas Maza

Share

Manufacturers’ transactions are complex. The ERP is the source of truth for complex business logic governing products, pricing, availability, and more–which is why eCommerce for manufacturers must include integration to SAP.

As you prepare for an SAP-integrated eCommerce solution, you also get the chance to reevaluate your business processes surrounding inventory availability for credit-blocked accounts.

Some manufacturers keep their customers on a short credit line in order to better manage their risk. Customers place orders and almost always have the order released by Customer Service. Although this is a workable process for order management, it may result in fewer sales in an SAP-integrated eCommerce channel, due to SAP’s default behavior when it comes to availability.

Here are your options for dealing with this in an eCommerce solution that’s integrated to SAP.

The problem: Your default credit handling in SAP may not be ideal for integrated B2B eCommerce

As a customer in the shopping cart, I need to know if a part is available so that I can promise it to the customer in front of me. If I see the part is not available on one website, I may go to another to buy it.

Since the Corevist shopping cart provides real-time availability information using sales order simulation, the cart may show no product availability for customers with bad credit (if that’s how your SAP system is set up).

In the pre-eCommerce world, that was totally acceptable. If a CSR (Customer Service representative) was acting as the middleman between the customer and SAP, they could tactfully communicate the credit situation. They could also tell the customer what steps to take to remedy the situation.

However, in the world of SAP-integrated B2B eCommerce, that user experience isn’t a good fit for every market or product line. If the customer logs on expecting to get availability information, and they can’t get it due to being on credit block, you may lose the sale.

Options for how to handle this

At a high level, you have two options for how to handle this in an SAP-integrated eCommerce channel:

- Totally ignore credit worthiness. Rather than blocking inventory information due to bad credit, you may choose to show real-time inventory or ATP to every logged-in user, plus allow order placement, regardless of the account’s credit status.

- Allow SAP’s credit rules to function in your integrated eCommerce channel. If your SAP system is set up to do so, this will block users from seeing inventory levels and placing orders if there is a credit issue with their account.

By default, the Corevist Platform will enforce your existing credit rules from SAP in the web store. However, in some cases, you may prefer to take the order and then see if your credit rules apply, rather than blocking the order due to bad credit.

Luckily, Corevist supports this with a simple change in SAP.

The solution: A simple, reversible tweak in SAP

To remedy this, your SAP team (or Corevist, if you wish) can develop a simple SAP enhancement to customize this behavior.

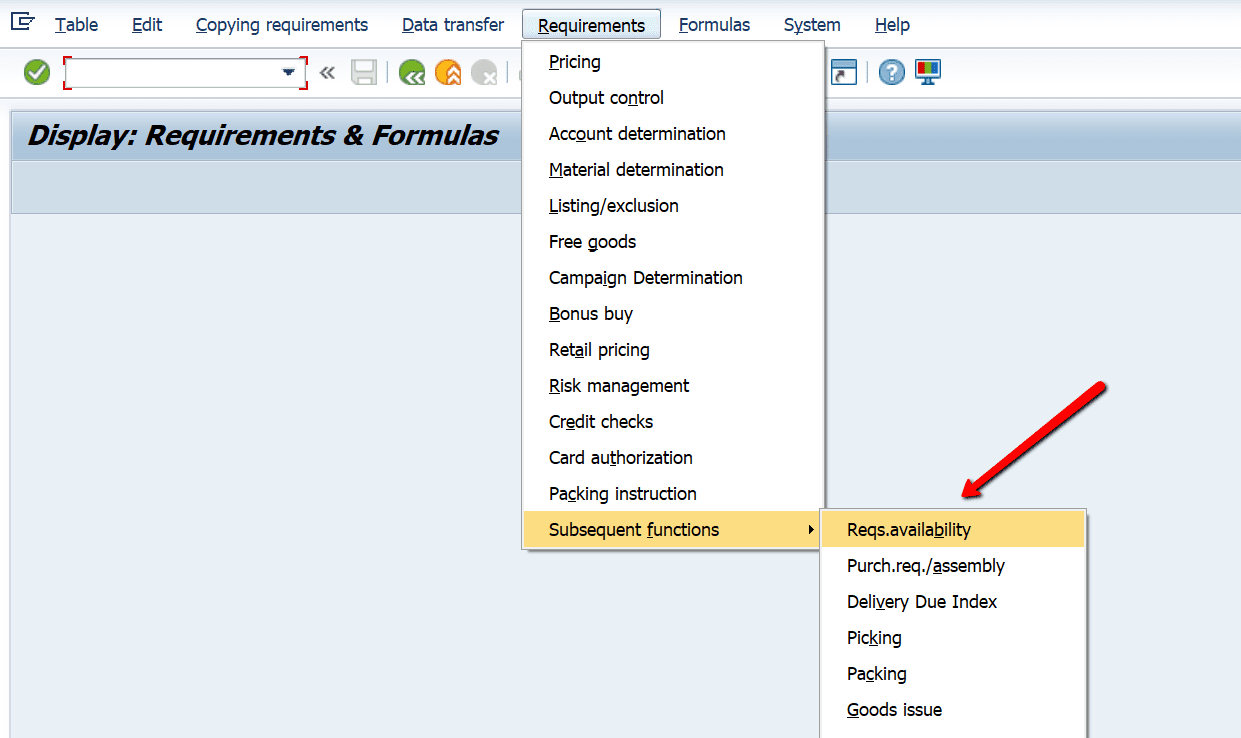

First, you must create a VOFM routine in transaction VOFM:

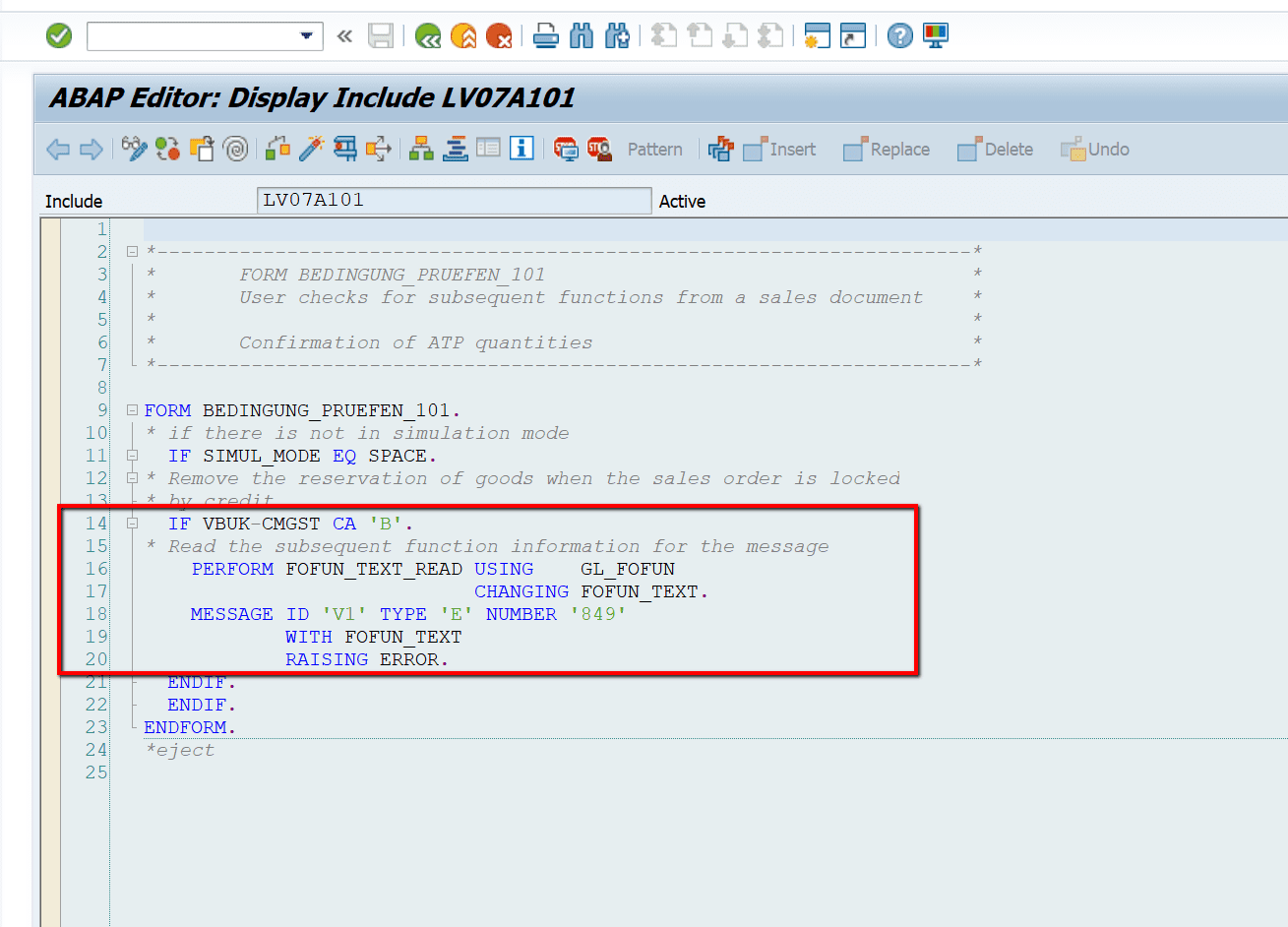

Next, you must add some code to control the behavior of availability checking in this scenario. Your code will depend on the processes which the business wants to support.

For sample code, see this article in the Corevist public knowledgebase.

Choosing how to handle credit + availability at your organization

So how do you apply this at your organization?

The answer depends on whether the product line in question is more specialized, or more commoditized.

High competition to purchase inventory ( = more specialized product)

If you’re a manufacturer with a tight inventory situation (i.e. you have high competition among customers for a limited amount of inventory), you may want to tighten up your credit rules. That way, you don’t let just anyone buy, since you don’t need the risk. You’ve got all sorts of other people to buy the product who do have good credit—and you’d rather sell to those customers first.

Low competition to purchase inventory ( = more commoditized product)

If you’re a manufacturer with low competition, long lead times, or large amounts of inventory, you may want to loosen up your credit rules. This way, you can take as many orders as possible, even if some go on block because of credit status. You can always go back to those customers, work out the credit situation, and release the order at that time.

Want to become Easier To Do Business With?

Check out the Corevist Platform.

Managed B2B portals and eCommerce with prebuilt integration for ECC and S/4HANA.