Paper checks and phone calls increase your cost to serve.

Many manufacturers still use paper-based processes for accounts receivable. Yet these processes can insert at least six business days into your order-to-cash cycle (four days in the mail, two days processing).

These practices are expensive—and they can create errors.

It’s time to modernize your B2B payments.

Add SAP-integrated payments to Corevist.

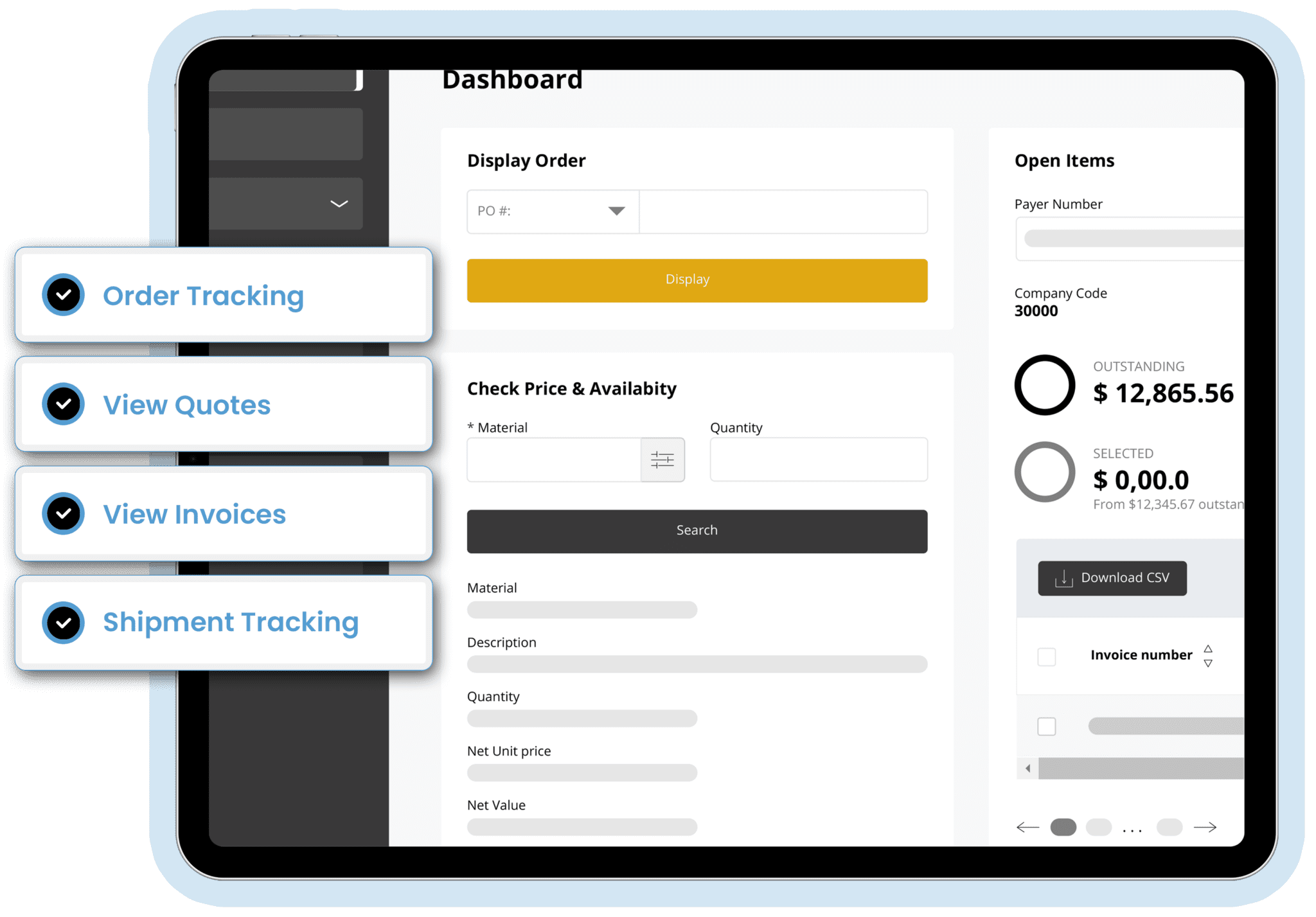

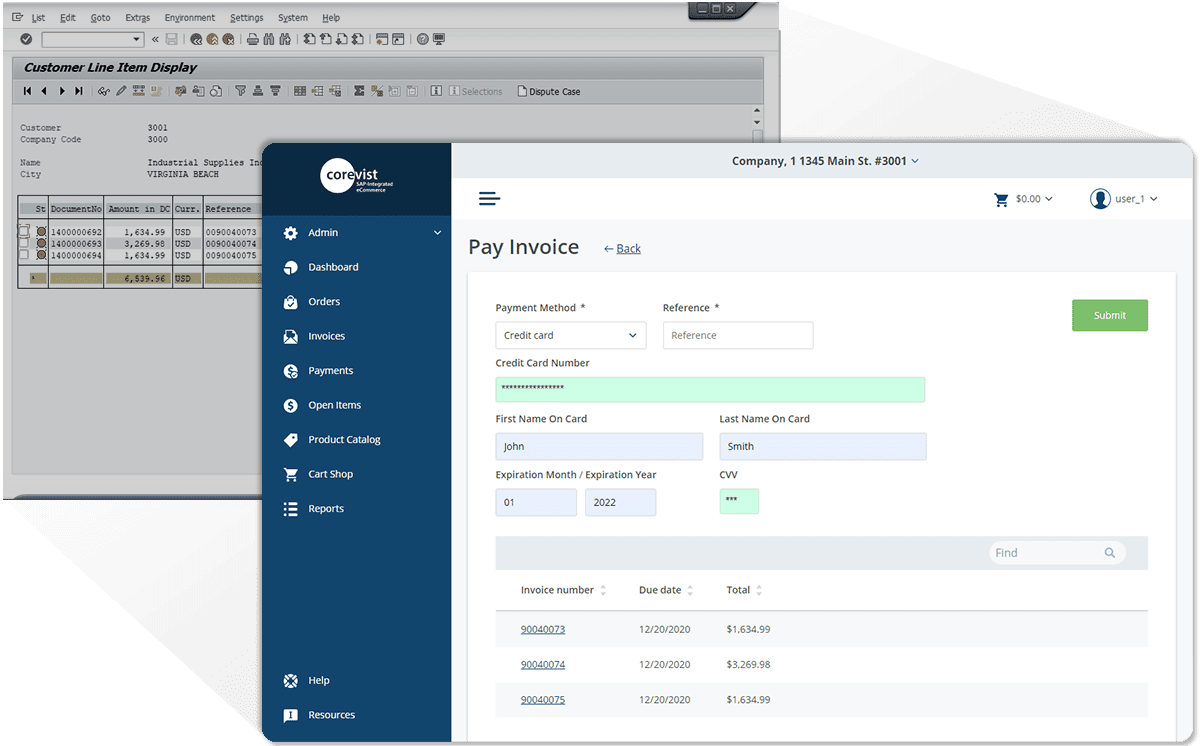

The Corevist Platform supports ePayments integrated to SAP through a PCI-compliant payment gateway (typically from a leading provider like Spreedly or Paymetric). With ePayments enabled, your Corevist solution empowers B2B users to make self-service payments through your preferred method(s), including:

- ACH transfer

- Credit/debit card

- eCheck

- Paypal

PCI-compliant ePayments on your terms.

The Corevist Platform supports the way you get paid. Some manufacturers allow ePayment at checkout, as the B2B customer places an order. Others retain their existing net 30/60/90 processes, giving customers access to invoices and self-service payment processing in Corevist.

Whether you choose one or both of these options, Corevist doesn’t store any data related to credit cards, bank accounts, or other financially sensitive information. Our architecture ensures PCI compliance through your chosen gateway provider, and our integration clears the relevant record in SAP in real time.

ePayments that fit your use case.

Every manufacturer has unique requirements when it comes to SAP B2B payments. That’s why our solution is flexible, ready to adapt to your business.

Here are some common use cases we see:

- Allowing customers to pay for an order during the checkout process.

- Allowing customers to pay in advance for a quote they’ve received.

- Allowing customers to pay down invoices and keep their accounts in good standing.

- Allowing internal A/R clerks to process payments on behalf of customers.

How does the SAP payment integration work?

Corevist’s direct, real-time integration eliminates the need for middleware and data synchronization.

When a B2B customer navigates to the Pay Invoices portion of your Corevist portal, our application pulls up the list of open items from the SAP FI-AR module in real time. When the user pays off the invoice, Corevist clears that open item in SAP and books the liability to a GL clearing account awaiting the bank to issue remittance.